| Analysis of Times Series with Stata |

| 3. Computing seasonal components and predicting with a multiplicative series |

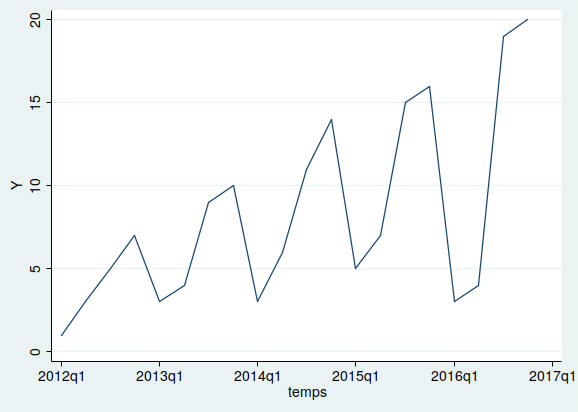

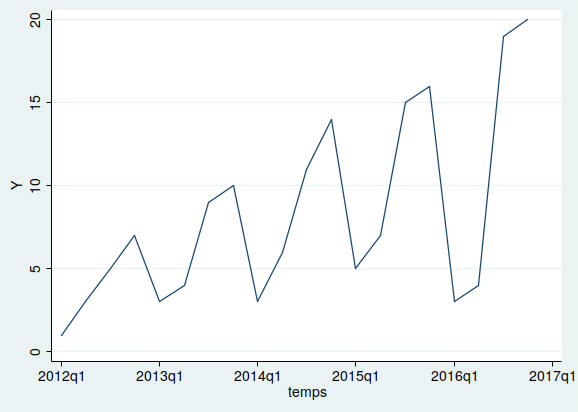

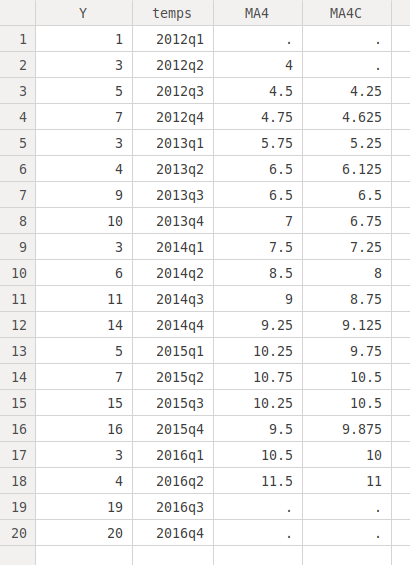

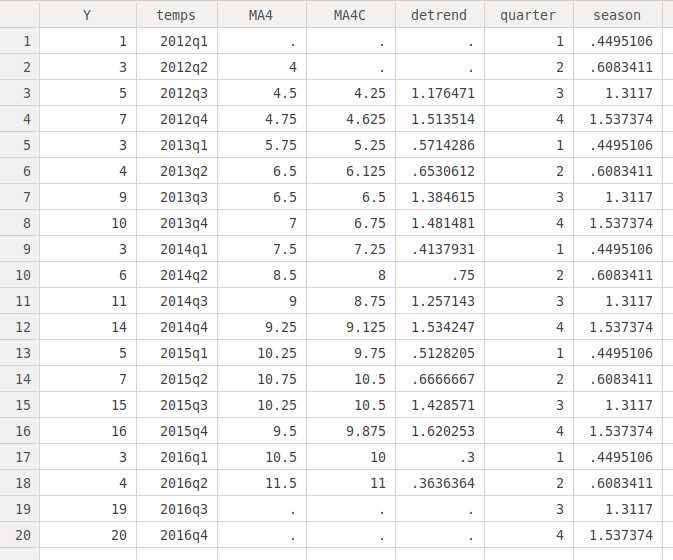

generate temps = tq(2012q1) + _n -1 format %tq temps tsset tempsWe now obtain the times series plot:

tsline Y

generate detrend = Y/MA4C

gen quarter = quarter(dofq(temps)) bysort quarter: egen season = mean(detrend) sort temps

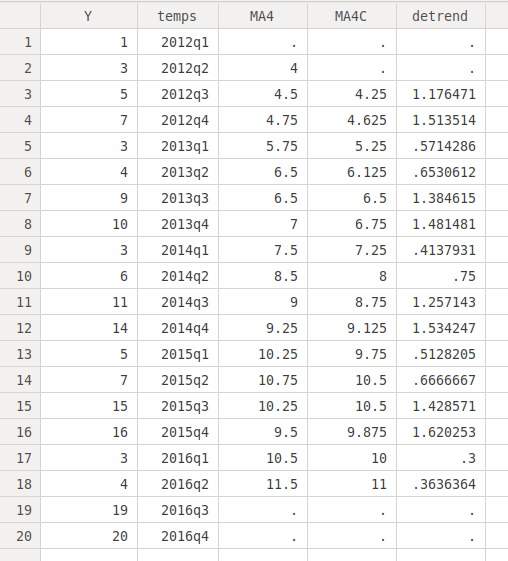

. reg Y temps Source | SS df MS Number of obs = 20 -------------+------------------------------ F( 1, 18) = 11.39 Model | 244.830451 1 244.830451 Prob > F = 0.0034 Residual | 386.919549 18 21.4955305 R-squared = 0.3875 -------------+------------------------------ Adj R-squared = 0.3535 Total | 631.75 19 33.25 Root MSE = 4.6363 ------------------------------------------------------------------------------ Y | Coef. Std. Err. t P>|t| [95% Conf. Interval] -------------+---------------------------------------------------------------- temps | .6067669 .1797891 3.37 0.003 .2290441 .9844897 _cons | -123.7218 39.11786 -3.16 0.005 -205.9054 -41.53823 ------------------------------------------------------------------------------And now we figure out the value of the time variable for the third quarter of 2017:

. di tq(2017q3) 230We now obtain the prediction for the trend for the third quarter of 2017:

. adjust temps = 230 ----------------------------------------------------------------------------------- Dependent variable: Y Command: regress Covariate set to value: temps = 230 ----------------------------------------------------------------------------------- ---------------------- All | xb ----------+----------- | 15.8346 ---------------------- Key: xb = Linear PredictionWe check the value of the seasonal component for the third quarter:

. list season if quarter == 3 +--------+ | season | |--------| 3. | 1.3117 | 7. | 1.3117 | 11. | 1.3117 | 15. | 1.3117 | 19. | 1.3117 | +--------+And we obtain the prediction adjusted by the trend, notice that we now multiply the seasonal component:

. di 15.8346*1.3117 20.770245It is predicted that "Y" will have a value of 20.770245 at the third quarter of 2017.